About us

promote the interoperability of payments acceptance

ensure the development, evolution and use of common standards

protect the interests of its member organizations

nexo standards has been the very first organization to design and develop payment acceptance messages based on ISO 20022 .

The delivery of universal standard and protocols messages ensure the interoperability of different equipment and payment systems, internationally.

nexo standards was established in 2014, when three historical contributors of payment standards and specifications were merged: EPASOrg, the OSCar consortium and the CIR SEPA-Fast technical working group.

nexo standards is at the origin of the entire ISO 20022 standardization process for payments acceptance and its membership base includes,

Acceptors, Processors, Schemes, Payment Service Providers and Vendors.

To simplify how payment acceptance is implemented everywhere.

As a community of leading payment experts, our mission is to define, publish and promote global payment acceptance standards and supporting services.

INTEROPERABILITY

By bringing together industry experts to develop open and common standards and implementation guidelines.

INNOVATION

By designing innovative and state-of-the-art message formats based on the functional and security requirements of the industry.

SECURITY

By protecting key elements of the transaction value chain through secure cryptographic mechanisms.

UNIVERSALITY

By issuing royalty-free standards leading to a worldwide payment acceptance open market.

TO DESIGN

Develop and maintain common payment acceptance standards protocols and specifications based on universal ISO accreditation

TO DELIVER

Common implementation guidelines to ensure full interoperability

TO PROVIDE

Test cases and tools helping implementers to evaluate their compliance with specifications

TO VALIDATE

Implementation thereby ensuring faster approval and deployment to market

TO PROMOTE

The universal use of nexo standards and specifications

TO SUPPORT

Users implementing nexo standards and specifications

ACCEPTORS

| TOTALENERGIES | François MEZZINA |

| MARKET PAY | Grzegorz JAGLARSKI |

| LOGICIELS COLOSSALE INC. | Alain GUITARD |

VENDORS

| CASTLES TECHNOLOGY CO.,LTD | François VOYRON |

| FRENCHSYS | Dolorès MIMRAN |

| SRC GMBH | Mirko Torgen OESAU |

| HPS WORLDWIDE | Pierre-Olivier SAINT-JOANIS |

CARDS SCHEMES

| DISCOVER | Leigh GARNER |

| EURO KARTENSYSTEME GMBH | Peter BLASCHE |

| MASTERCARD | Laurent BRÉCHON-CORNERY |

| UNIONPAY INTERNATIONAL CO. LTD. | Shengliang YANG |

| VISA | Seema SHARMA |

PAYMENT SERVICE PROVIDERS

| BNP PARIBAS | Massimo CICARDO |

| CAISSE FÉDÉRALE DE CREDIT MUTUEL | Thierry MUCKENSTURM |

| CREDIT AGRICOLE | Sophie GIORGI |

| BPCE PAYMENT SERVICES | Fabrice DENÈLE |

PROCESSORS

| FIME | Arnaud CROUZET |

| FISERV | Lucian LAURITZ |

| NEXI PAYMENTS | Jean-Philippe JOLIVEAU |

| INGENICO | Arnaud LUCIEN |

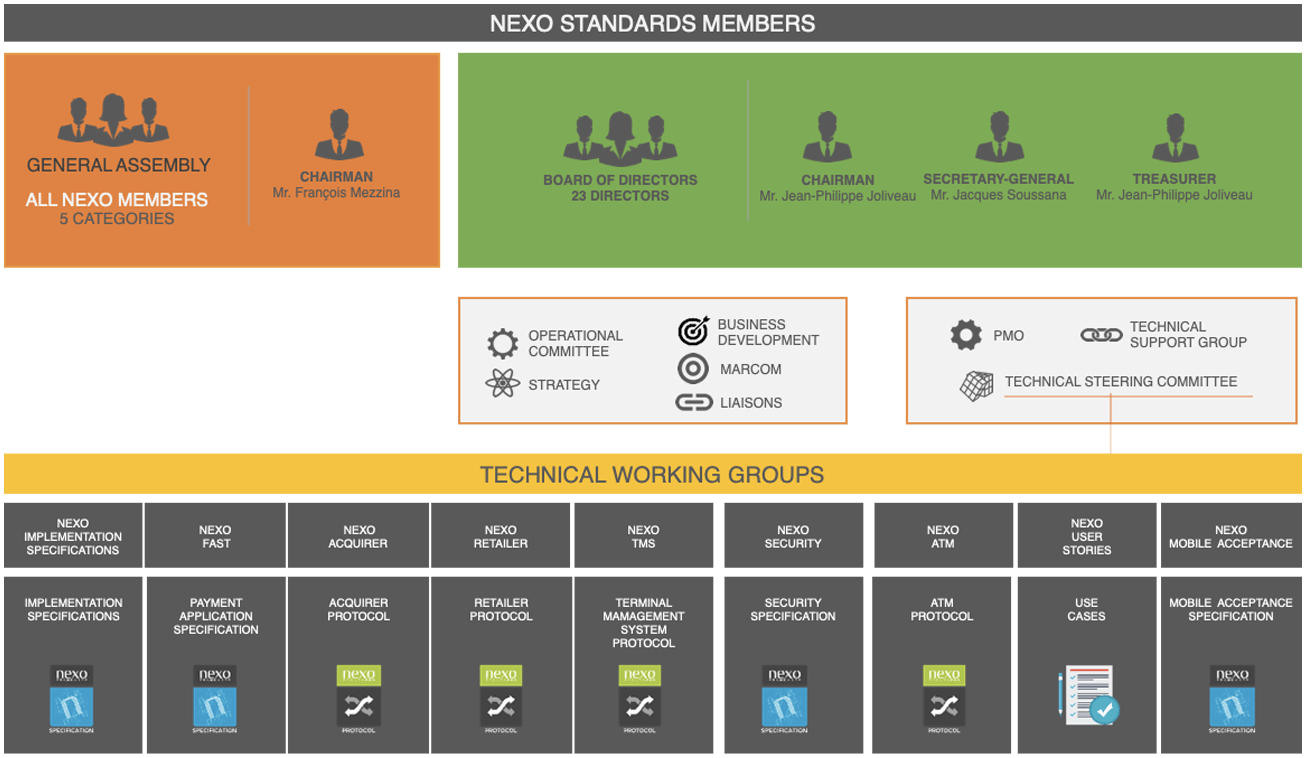

The Technical Steering Committee determines the Terms of Reference, the composition and the mandate duration of Working Groups.

Once a member of the nexo organization, businesses could get involved in one or as many working groups they wish to.

By getting involved in the working group, they could share their expertise and make sure protocols and specifications enhancement would meet the market needs.

Task Forces are created under the leadership and supervision of the relevant Working Group(s).

technical steering committee

nexo Acquirer protocol

nexo Retailer protocol

nexo TMS protocol

nexo ATM protocol

nexo implementation specification

nexo fast specifications

Technical support group

Mobile Initiated Payment Acceptance

Strategic Working Group

Operational Committee

Marketing and Communication

Principal members

Associate members

Observers

Counsellors are not Members of the Association.

May become a Counsellor a representative of a national or international institution being in charge of the regulation and/or supervision of card payments and/or other means of electronic payments. A Counsellor can be invited to attend General Assembly, committees, Working Groups and Task Forces meetings established within the Association.

- They cannot vote at the General Assembly.

- A Counsellor has no access to any draft specifications and standards, or any documents produced by the Association that are not public.

Counsellors

nexo standards is the association dedicated to removing the barriers present in today’s fragmented global payment acceptance ecosystem.

It enables fast, borderless and global payments acceptance by standardizing the exchange of data between all payment acceptance stakeholders. nexo is a not-for-profit, open association; its membership represents the full spectrum of payment stakeholders including merchants and other payment acceptors, processors, card schemes, payment service providers and vendors.

An organization inheriting the developments of 3 predecessor organizations

The OSCar project was launched in order to foster the development of SEPAwide POI solutions implementing:

The SEPA-FAST payment application specified by the CIR

The EPAS ISO20022 Acquirer / TMS protocol specified by EPASOrg

Packaged in the OSCar Integration Specification (OIS) as an efficientalternative to the legacy, country or scheme specific, POI payment solutions

SEPA-FAST stands for SEPA-“Financial Application Specification for SCS Volume Compliant Terminals".

The aim of the SEPA-FAST Technical Working Group is to harmonize technical specifications for EMV implementations for any card-based payment system.

In 2007, the SEPA-FAST Technical Working Group started working for the European Payments Council (EPC) Cards Working Group as the Identified Initiative for the Card-to-Terminal and Cardholder-to-Terminal standardization domains. The SEPA-FAST Technical Working Group contributed to the Functional Requirements in the SEPA Cards Standardisation Volume, managed by the European Payments Stakeholders Group (EPSG).

In 2005, at the initiative and under the coordination of Groupement des Cartes Bancaires (CB) in France, a group of card schemes, acquirers, retailers, and payment solution providers belong ingto the card payment value chain, set up a consortium to address the interaction between electronic payment terminals and other systems in the card transaction ecosystem. That group was the predecessor to what is now EPASOrg.

The consortium started by defining three main protocols to be used in a POI (Point of Interaction) environment:

The Acquirer protocol, The TMS protocol, The Retailer protocol

By fall 2005, the members of the consortium endorsed a Consortium Agreement,modelled on the framework of an Information Technology for European Advancement (ITEA) European research program. Over the next three years, work continued on the definition of the EPAS protocols, with an iterative revision process enabling state-of-the art technology and security requirements to be incorporated into the specifications.

From its inception, the EPAS initiative has developed its project with a clear aim to enable card payment industry stakeholders to benefit from the extensive expertise of the EPAS consortium and later EPASOrg in the implementation of concrete projects.